5 ways to avoid greenbotching in your company

In this article we’ll explore what greenbotching is and why it is harmful. We’ll also provide 5 effective ways to avoid it.

Your request has been taken into account.

An email has just been sent to you with a link to download the resource :)

The UK's Streamlined Energy and Carbon Reporting (SECR) regulation is a pivotal step towards enhancing climate transparency among UK businesses. It acknowledges the pressing need to evaluate both the risks of climate change and the energy efficiency of the broader economy.

Climate change doesn't just pose a threat to our environment - it's a significant economic concern too. For instance, Swiss Re, one of the world's leading reinsurance firms, has projected that without policy intervention, the world stands to lose up to 18% of its GDP by 2050.

Recognizing this, the UK has been proactive in aiding investors who wish to incorporate both climate and financial performance considerations into their investment decisions. However, this has often been hindered by the lack of high-quality data from corporations. To address this issue, the UK introduced the SECR, modernizing its carbon accounting disclosure rules and broadening the spectrum of businesses under its purview.

👉 In this article we’ll explore what the SECR is, why it was introduced, and what it means for companies operating in the UK.

The UK’s Streamlined Energy and Carbon Reporting (SECR) regulation requires certain companies - such as quoted companies, large unquoted companies, and limited liability partnerships (LLPs) - to annually report their energy emissions and Scope 1 and 2 carbon emissions.

The UK rolled out the SECR on April 1, 2019, mandating large businesses and charitable organizations to annually disclose their energy use and carbon emissions. Furthermore, these entities are required to detail the energy-efficiency measures they've adopted each year.

Coinciding with the introduction of SECR, the Carbon Reduction Commitment (CRC) Energy Efficiency Scheme was phased out. The SECR expands its reach, compelling approximately 11,900 UK-based companies to reveal their emissions - significantly more than the CRC ever did.

It's crucial to note that the SECR doesn't replace or override several existing emissions reporting mandates, which continue to operate:

The SECR aims to create harmony between fiscal responsibility and environmental stewardship. Through carbon accounting, it enables businesses to trim costs, boost transparency via carbon disclosures, and enhance energy efficiency. In turn, this helps companies curtail their greenhouse gas emissions and combat the repercussions of climate change by endorsing energy-efficient practices.

Furthermore, the SECR fosters greater awareness regarding the implications of climate change and the intricacies of energy expenditure within organizations. It not only sheds light on the monetary aspect of energy but also enlightens stakeholders about a company's role in climate change.

For investors, the data on carbon emissions and energy usage that the SECR mandates is invaluable. As companies focus on augmenting energy efficiency and diminishing carbon emissions, investors are equipped with sharper insights. This helps investors to make more informed investment choices in a world gravitating towards sustainability.

👉 To learn about how companies can reduce the carbon footprint of their business, head over to our article.

The SECR impacts an estimated 11,900 companies incorporated in the UK. These businesses fall under three main categories. All companies that meet the following criteria are obligated to report their emissions and energy consumption unless they fall under one of the exemptions:

Quoted companies of any size: These are companies listed on a public exchange. Such companies are already subject to existing greenhouse gas reporting regulations, so the 2019 update doesn’t significantly affect them.

Large unquoted companies: The term "large", as defined by the Companies Act 2006, applies to a company that fulfills at least two of the following criteria:

Large limited liability partnerships (LLPs): LLPs are considered to be large where they fulfill the same criteria outlined above as per the Companies Act 2006.

Charities and not-for-profit organizations: Where an organization meets the Companies Act 2006 definition of large it will also fall under the scope of SECR, even where it operates under a charitable structure.

Public bodies: Public bodies do not fall under the scope of SECR, however, they may have other carbon reporting obligations. It’s worth noting that not all organizations providing a public service are officially defined as such, and therefore some bodies owned by the NHS or a UK University may still fall under the scope of SECR.

SECR includes several possible exemptions, these include:

In some cases, a group-level report is required. A group-level report should contain the energy use and carbon emissions data for the parent group and all subsidiaries.

As outlined above under the section on exemptions, if a subsidiary would not otherwise be required to report under SECR independently from the group, it may omit its energy and carbon details in the group report.

❗ Reporting companies should note that this specific guideline is treated differently than in the ESOS and the CRC Energy Efficiency Scheme.

Note that when subsidiary companies subject to SECR have already reported their energy and carbon information in a parent’s group-level report, filing a separate energy and carbon report isn't necessary.

SECR reporting requirements vary depending on the type and size of the business or organisation. Below we’ve outlined how quoted companies, large unquoted companies, and LLPs should present their energy and carbon reporting.

Quoted companies are already required to report their Scope 1 and 2 worldwide GHG emissions. The emissions should be reported in tonnes of carbon dioxide equivalent (CO2e) covering the seven gases listed in the Kyoto Protocol.

Companies are strongly recommended to report Scope 3 emissions if they are essential to business operations, however, for now reporting on Scope 3 emissions is not mandatory, and is voluntary only.

💡GHG emissions that must be reported include: carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), and sulphur hexafluoride (SF6), and nitrogen trifluoride (NF3).

Quoted companies should also report their selected emissions intensity ratios for the current and previous years. This should be stated in their Directors' report.

❓ Emissions intensity ratios define GHG emissions in relation to the scale of business operations. Intensity metrics help regulators compare companies’ energy efficiency with counterparts of a similar size. Examples of intensity metrics include tonnes of CO2e per sales revenue or per square metres of total floor space.

Beyond emissions, listed companies should report their annual energy use. Companies should specify both their UK energy use and their offshore energy use in other countries.

If the first year of SECR reporting has passed, quoted companies also need to report a comparison between the current and previous reporting years.

SECR requires quoted companies to describe whether or not they implemented measures aimed at reducing carbon emissions throughout the course of the year. They should disclose a narrative description of their energy-efficient activities in their annual report, and how successful those measures have been in improving energy efficiency or reducing energy consumption.

Companies should outline the methodology used. While there is no specific recommended methodology, SECR recommends selecting one that is widely used, comprehensive, and transparent.

Quoted companies should report these details in their Director’s Reports for financial years beginning from April 1, 2019.

Here’s a quick SECR reporting checklist for quoted companies:

SECR requires large unlisted companies and large LLPs to report on the following information:

UK energy use (including the UK offshore area) in three categories: electricity, gas, and fuel for transport.

Associated GHG emissions from these activities should also be reported, with at least one emissions intensity ratio included.

❗ Note: When reporting transport energy use, businesses should report their direct fuel purchases for company vehicles, but there is no need to report fuel used from a third-party operator. Fuel used in flights, trains, public transport, taxi trips, freight, or shipping for services contracted to a third party is also excluded.

Like quoted companies, large unquoted companies and large LLPs also need to provide a narrative description of their energy efficiency activities and details on the methodology they used.

Also similar to quoted companies, large unquoted companies should provide the required information in their Directors’ Reports, or Strategy Reports alongside an explanation.

Large LLPs should report the information in their Energy and Carbon Report (a new obligation that was brought in with SECR).

Here’s a quick SECR reporting checklist for large unquoted companies and large LLPs:

The SECR guidelines set a foundational benchmark for successful GHG reporting to mitigate the impacts of climate change, but there's room to go beyond the basics. Here's what's additionally recommended:

Full Disclosure: Companies should share details about all significant sources of energy consumption or greenhouse gas emissions, even those not specified in the guidelines. This includes Scope 3 emissions, which are the indirect emissions that occur in a company's value chain.

Science-backed Targets: Companies should aim to align their reporting with science-based goals, such as aiming to keep global warming below 1.5 degrees Celsius by 2100.

Future-focused Analysis: The Task Force on Climate-related Financial Disclosures (TCFD) suggests companies look ahead and analyze how climate change might affect them. This involves:

Risk Assessment: The TCFD encourages companies to evaluate climate risks, both direct (like storms or rising sea levels) and indirect (like changes in policies, markets, technologies, potential lawsuits, or harm to their reputation).

In certain situations, companies might find it challenging to include their energy and carbon emissions data in their annual streamlined reports. Reasons could range from facing exceptional difficulties in gathering the data to concerns that sharing such information might harm the company's interests.

Companies choosing to withhold such data should clearly state their reasons for doing so. However, they're also expected to make efforts to fully comply in subsequent reports.

SECR only mandates Scope 1 and Scope 2 reporting, however, it is strongly recommended that companies also adopt Scope 3 reporting. Let’s take a closer look at the different Scopes and what they encompass below:

The GHG Protocol defines the three emissions reporting Scopes as follows:

Scope 3 emissions are an important part of most companies’ carbon footprint, making up around 80% of their total carbon emissions. While there is currently no requirement to report on Scope 3 emissions, this may change in the future.

❓Scope 3 emissions data is more challenging for companies to collect, as they aren't created by the company themselves. It includes the supply chain emissions created when manufacturing and shipping products, as well as the emissions caused by the end-users when consuming the products, goods, or services.

👉 To find out more about the different Scopes, why not read our article on the topic. Or if you'd like to learn more about carbon accounting take a look at our blog.

Working with specialized carbon accounting experts like Greenly can improve the quality of your reporting across all 3 Scopes, so why not get in touch with us today?

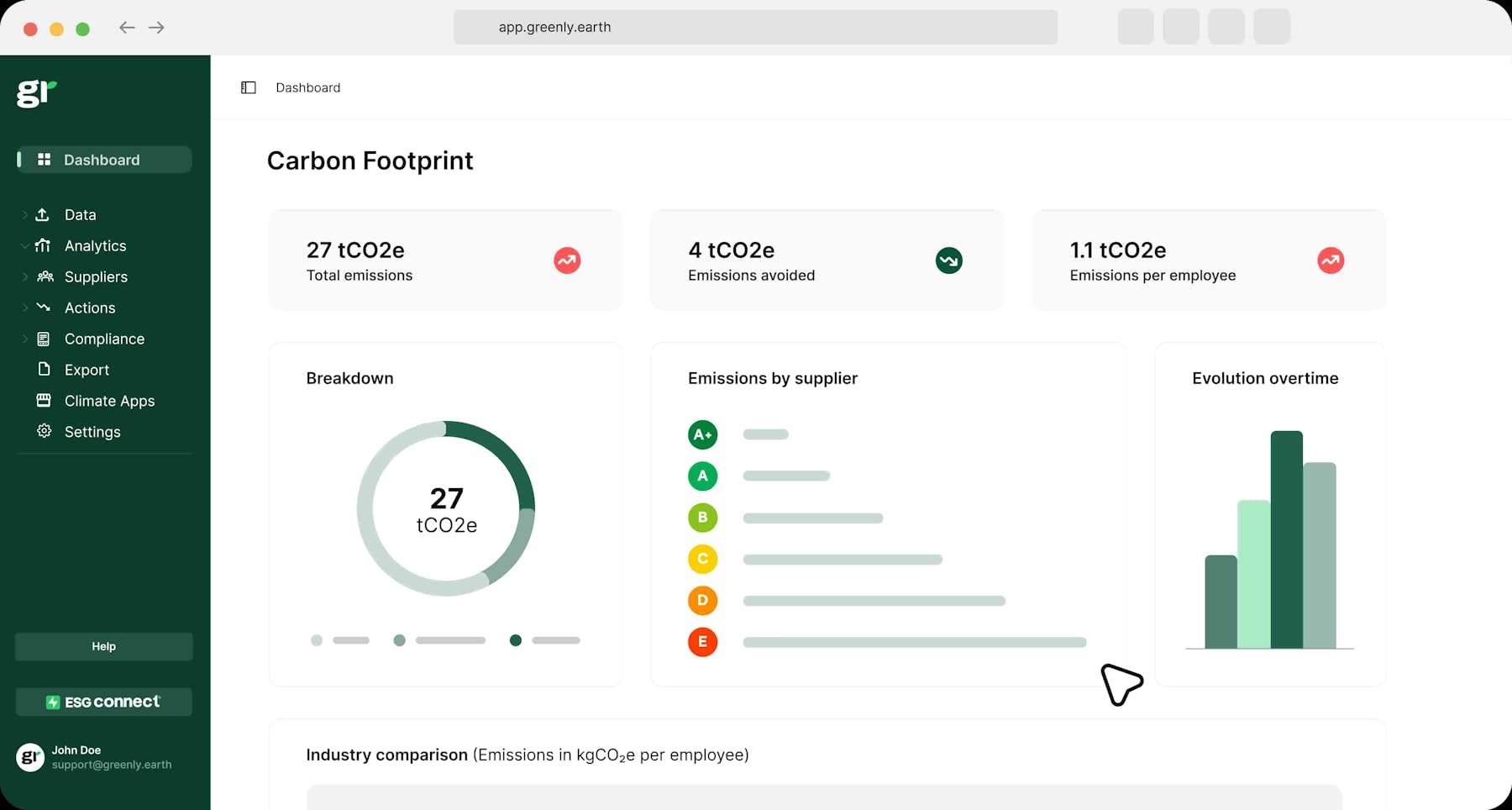

At Greenly we can help you to assess your company’s carbon footprint, and then give you the tools you need to cut down on emissions. Request a free demo today with one of our experts - no obligation or commitment required.

If reading this article has inspired you to consider your company’s own carbon footprint, Greenly can help. Learn more about Greenly’s carbon management platform here.

We share green news once a month (or more if we find interesting things to tell you)